Navigating the World of Payment Processing in 2025

Payment processing has become a staple in the digital era, facilitating online transactions and ensuring security for businesses and consumers alike. As we forge ahead into 2025, it’s crucial to stay informed about the latest trends and technologies shaping the payment processing landscape.

Brief Overview of the Importance of Payment Processing

Payment processing is the backbone of online transactions, enabling businesses to accept customer payments securely and efficiently. In today’s fast-paced digital environment, a reliable payment system is vital for maintaining customer trust and optimizing business operations. With the rise of e-commerce and mobile payments, understanding the intricacies of payment processing can help businesses stay competitive and minimize transaction costs.

Secure payment systems protect sensitive financial information, ensuring customer data remains confidential. This is especially important as cyber threats continue to evolve. Moreover, robust payment processing can help businesses manage cash flow, reduce payment processing fees, and mitigate fraud risks.

Main Topics to be Covered in the Blog

In this blog, we will delve into several key topics that are pivotal for understanding the current state and future outlook of payment processing. These include:

- The future of payment security: Explore emerging technologies and practices that are shaping payment security in 2025.

- Trends in digital and mobile payments: Learn about the latest trends and advancements in digital and mobile payment solutions.

- Payment regulations: Understand how evolving regulations impact payment processing and what businesses need to know to stay compliant.

- Innovations in payment gateways: Discover how payment gateways are evolving to meet the demands of modern e-commerce solutions.

- Financial technology advancements: Examine how fintech innovations are transforming payment systems and services.

- Challenges and solutions in payment processing: Identify common pain points and explore solutions to overcome them.

The Future of Payment Security

As cyber threats become more sophisticated, the future of payment security will be marked by advanced encryption technologies and rigorous authentication processes. Businesses must adopt multi-layered security measures to protect against data breaches and fraud. Biometric authentication and tokenization are on the rise, providing additional layers of security for online transactions.

Furthermore, blockchain technology is gaining traction as a means to enhance transparency and security in payment processing. By decentralizing transaction records, blockchain reduces the risk of data tampering and fraud. Understanding these emerging security protocols will be crucial for businesses looking to safeguard their payment systems in 2025.

Trends in Digital and Mobile Payments

The shift towards digital and mobile payments continues to accelerate. Contactless payment solutions, such as NFC (Near Field Communication) and QR codes, are becoming more prevalent, driven by the demand for convenience and speed. Mobile wallets, such as Apple Pay and Google Wallet, offer consumers a simple and secure method to make payments using their smartphones.

Additionally, cryptocurrency is slowly making its mark in the world of digital payments. While still facing regulatory challenges, cryptocurrencies offer a decentralized and secure method of transaction that appeals to a growing segment of tech-savvy consumers. Staying ahead of these trends will be essential for businesses aiming to provide cutting-edge payment solutions to their customers.

Payment Regulations

Navigating the complex landscape of payment regulations is crucial for any business involved in payment processing. Compliance with regulations such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation) is mandatory to ensure the protection of customer information and avoid legal repercussions.

In 2025, we can expect stricter regulations around data privacy and security. Businesses must stay informed about these changes and implement necessary measures to remain compliant. Collaboration with payment service providers who offer comprehensive compliance support can be a strategic move to mitigate risks and navigate regulatory challenges effectively.

Innovations in Payment Gateways

Payment gateways are the bridge between merchants and payment processors, facilitating secure and efficient transactions. Innovations in this space are focused on improving transaction speed, security, and user experience. Intelligent routing technology, for instance, optimizes transaction processing by directing payments through the most efficient pathways.

Integration capabilities are also expanding, allowing payment gateways to seamlessly connect with various ecommerce platforms and accounting systems. This interoperability enhances business flexibility and operational efficiency, enabling smoother financial transactions and better data management.

Financial Technology Advancements

Financial technology, or fintech, is revolutionizing payment systems with innovative solutions designed to streamline transactions and enhance customer experiences. From automated payment reconciliation to AI-powered fraud detection, fintech advancements are setting new standards in payment processing.

Machine learning algorithms are increasingly being utilized to analyze transaction patterns and predict potential fraudulent activities. By leveraging data analytics, businesses can gain valuable insights into consumer behaviors and optimize their payment processes accordingly. Embracing these technologies will be imperative for businesses aiming to stay ahead in the competitive financial landscape.

Challenges and Solutions in Payment Processing

While the evolution of payment processing offers numerous benefits, it also presents challenges that businesses must address. High credit card processing fees, complex payment solutions, and the need for secure transaction environments are common pain points.

To tackle these issues, businesses can explore cost-effective merchant services and adopt payment solutions that offer transparent fee structures. Partnering with a reliable payment service provider, such as Q Solutions LLC, can provide tailored solutions designed to minimize costs and combat fraud. By leveraging the expertise of professionals in the industry, businesses can navigate payment processing complexities and ensure secure, reliable transactions.

In conclusion, the world of payment processing in 2025 is dynamic and evolving, driven by technological advancements and regulatory changes. By staying informed about emerging trends, adopting new security measures, and collaborating with trusted service providers, businesses can optimize their payment systems and provide a seamless experience for their customers.

Navigating the World of Payment Processing in 2025

As the landscape of commerce continues to shift towards digital transactions, understanding payment processing has become more essential than ever for businesses. In 2025, the rapid advancements in financial technology and the increasing complexity of payment systems make it imperative for businesses to grasp the fundamentals of payment processing and the reasons why it is crucial. This article aims to provide a comprehensive overview of payment processing, its importance, and its evolving trends.

Payment Processing in Digital Economy

Definition of Payment Processing

Payment processing refers to the series of operations involved in completing a transaction between a customer and a business. It encompasses the steps taken to authorize, process, and settle payment transactions made through various mediums such as credit cards, debit cards, mobile payments, and online banking. The primary players in payment processing include merchants, acquiring banks, issuing banks, payment gateways, and payment processors.

At the heart of the payment processing ecosystem are payment gateways and payment processors. A payment gateway acts as an intermediary between the merchant’s website and the payment processor, ensuring that the transaction information is securely transmitted and authorized. Payment processors, on the other hand, handle the movement of funds from the customer’s bank account to the merchant’s account. Together, they facilitate the seamless operation of online transactions.

Why Payment Processing is Crucial for Businesses in the Digital Economy

The digital economy has led to a significant increase in the volume and variety of transactions businesses must handle. With more consumers opting for online shopping and mobile payments, businesses must be equipped to manage these payments seamlessly. Here are some key reasons why payment processing is critical for businesses:

A) Ensuring Transaction Security

As online transactions become more prevalent, the need for robust payment security measures has never been greater. Businesses must ensure that their payment processing systems are equipped with advanced security protocols to protect sensitive customer data from breaches and fraud. Payment security involves measures such as encryption, tokenization, and adherence to Payment Card Industry Data Security Standards (PCI DSS), which help mitigate the risks associated with online payments. By prioritizing payment security, businesses can build trust with their customers, which is essential for maintaining a positive reputation.

B) Enhancing Customer Experience

The efficiency and reliability of payment processing systems directly impact the customer experience. A smooth and hassle-free payment process can enhance customer satisfaction and increase the likelihood of repeat business. In contrast, a complicated or unreliable payment process can lead to cart abandonment and lost sales. Therefore, businesses must invest in robust payment gateways and processors that offer fast, secure, and user-friendly payment solutions. Features such as multiple payment options, one-click payments, and mobile-optimized checkouts are essential in catering to the diverse preferences of modern consumers.

C) Adapting to Payment Trends and Innovations

Emerging payment trends and innovations continue to shape the way businesses handle transactions. In 2025, trends such as contactless payments, mobile wallets, and cryptocurrencies are expected to gain further traction. Businesses must stay informed and adaptable to leverage these trends to their advantage. Implementing flexible payment systems that can integrate with various payment methods allows businesses to cater to a wider customer base and stay competitive. Additionally, staying updated with regulatory changes and compliance requirements ensures that businesses remain in good standing with authorities while offering secure and compliant payment solutions.

D) Optimizing Financial Operations

Effective payment processing not only benefits customer experience but also optimizes financial operations for businesses. By automating payment processes, businesses can reduce manual errors, save time, and improve cash flow management. Comprehensive payment processing solutions offer detailed transaction reporting, reconciliation tools, and performance analytics that provide valuable insights into sales patterns and customer behavior. Armed with this data, businesses can make informed decisions to streamline their operations and implement strategies that drive growth.

In conclusion, understanding the intricacies of payment processing is pivotal for businesses navigating the digital economy in 2025. By recognizing its importance in ensuring transaction security, enhancing customer experience, adapting to payment trends, and optimizing financial operations, businesses can position themselves for success in an increasingly digital world.

Q Solutions LLC is dedicated to assisting businesses of all sizes with reliable, efficient, and secure payment processing solutions. Our commitment to transparency and expert guidance makes us the ideal partner in your journey towards optimized transactions. Explore our services in Merchant Dual Pricing, credit and debit card processing, customizable gift and loyalty card programs, and more to find the solutions best suited to your business needs.

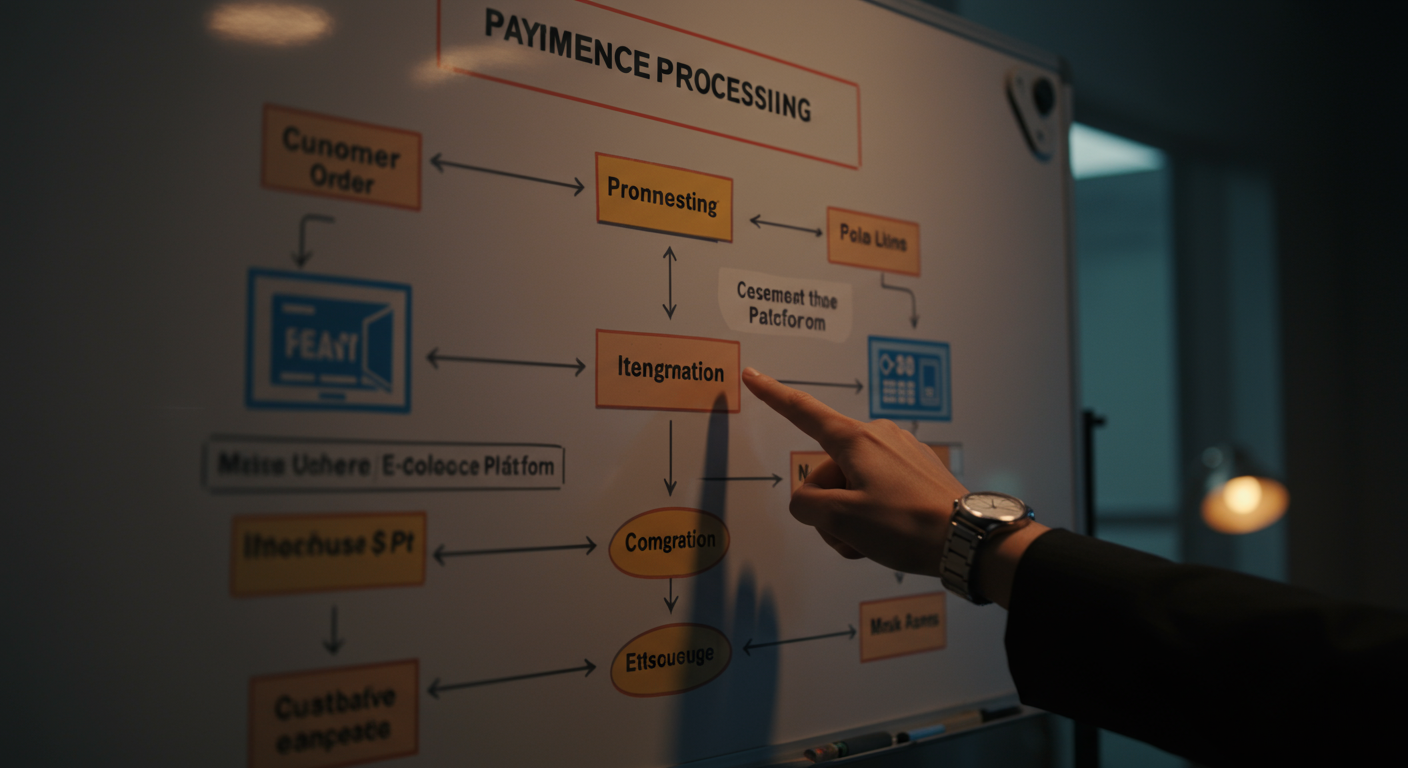

Key Components of Payment Processing

As businesses continue to evolve and adapt to new market demands, understanding the key components of payment processing is crucial for success. From accepting online payments to ensuring payment security, a well-rounded knowledge of payment processing can help businesses manage transactions more effectively. In this blog, we will explore the roles of payment gateways, the functions of merchant accounts, and the importance of payment processors in facilitating transactions.

Payment processing illustration

The Roles of Payment Gateways

Payment gateways are essential tools in the online payment landscape. They serve as the bridge between your customers’ payment information and your bank account. When a customer initiates a transaction, the payment gateway securely transmits the payment information to the payment processor, ensuring that the data is encrypted and safe from unauthorized access.

Payment gateways provide several critical functions to support seamless online transactions. Firstly, they handle encryption, converting sensitive payment information into secure code that can be safely transmitted over the internet. This helps protect against fraud and ensures the integrity of the transaction data. Secondly, payment gateways validate the transaction details to ensure that the provided information is accurate and complete. This validation helps prevent errors that could disrupt the payment process.

Moreover, payment gateways facilitate the authorization process by communicating with the issuing bank to verify the availability of funds in the customer’s account. Once the transaction is approved, the gateway informs both the customer and the merchant, allowing the transaction to be completed. Finally, payment gateways support diverse payment options, including credit and debit cards, digital wallets, and alternative payment methods, providing flexibility and convenience for both businesses and customers.

The Functions of Merchant Accounts

Merchant accounts are specialized bank accounts that enable businesses to accept and process card payments. These accounts act as holding areas where funds from customer transactions are temporarily stored until they are settled into the merchant’s business bank account. Having a merchant account is a fundamental requirement for businesses that wish to accept card payments.

One of the primary functions of merchant accounts is to manage the flow of funds from card transactions. When a customer makes a payment, the funds are first deposited into the merchant account before being transferred to the business account, typically within a few business days. This process helps ensure that there are sufficient funds to cover potential chargebacks or refunds, providing a level of financial security for both merchants and customers.

Merchant accounts also facilitate the settlement process, where transactions are batched and sent to the acquiring bank for processing. The acquiring bank works with the card networks (such as Visa and Mastercard) to complete the transaction and transfer the funds to the merchant’s business account. This process involves several steps, including authorization, clearing, and settlement, each contributing to the efficient management of payment processing.

Additionally, merchant accounts come with various features and tools designed to support business operations. These may include transaction reporting, fraud detection, and chargeback management, helping businesses maintain control over their payment processes and mitigate potential risks. By leveraging the capabilities of merchant accounts, businesses can optimize their payment processing systems and provide a better experience for their customers.

Payment Processors in Facilitating Transactions

Payment processors play a vital role in the payment ecosystem, acting as intermediaries between merchants and financial institutions. Their main function is to handle the transaction process from start to finish, ensuring that payments are processed accurately and efficiently. Payment processors work in the background to facilitate the movement of funds and provide the necessary infrastructure for seamless payment operations.

One of the key responsibilities of payment processors is to ensure the security of transactions. They implement robust security measures, such as encryption and tokenization, to protect sensitive payment information from unauthorized access. Payment processors also conduct regular security audits and compliance checks to adhere to industry regulations and standards, helping businesses maintain a secure transaction environment.

In addition to security, payment processors manage the authorization and settlement processes. During authorization, the payment processor verifies the validity of the payment information and checks for sufficient funds in the customer’s account. This step is crucial for preventing fraud and ensuring that transactions are legitimate. Once the transaction is authorized, the payment processor handles the settlement, which involves transferring the funds from the customer’s bank to the merchant’s account.

Moreover, payment processors offer a range of services to support business operations. These may include transaction reporting, analytics, and customer support, providing valuable insights and assistance to merchants. By partnering with reliable payment processors, businesses can ensure a smooth and efficient payment processing experience for their customers.

In conclusion, understanding the key components of payment processing is essential for businesses looking to optimize their transaction systems. Payment gateways, merchant accounts, and payment processors each play a crucial role in facilitating secure and efficient online payments. By leveraging these components, businesses can enhance their payment processing capabilities, provide a better customer experience, and ultimately, drive growth and success in the modern marketplace.

Popular Payment Processing Methods

The world of payment processing has evolved significantly in recent years, offering businesses and consumers a variety of methods to handle transactions securely and conveniently. Understanding these popular payment options can help businesses choose the best solution to meet their needs. This blog section will delve into the prevalent payment processing methods, providing insights into their benefits and applications.

image description

Credit/Debit Card Payments

Credit and debit card payments remain one of the most popular methods for processing transactions. Whether purchasing online or in-store, these cards offer consumers convenience and security. Credit cards allow users to borrow money up to a certain limit for purchases, while debit cards deduct money directly from the user’s bank account.

Credit cards often come with various perks, such as cashback, rewards points, and travel benefits, making them attractive to consumers. Debit cards, on the other hand, provide a straightforward way for individuals to manage their finances by spending only what is available in their bank account. Businesses benefit from accepting card payments as it ensures faster transactions, reduced cash handling, and the ability to cater to a broader customer base.

Merchants typically need to work with payment processors that offer credit card processing services, ensuring they have the necessary infrastructure to handle card payments securely. It is also crucial for businesses to understand the associated processing fees and choose the right service provider to avoid high costs.

Digital Wallets (e.g., PayPal, Google Pay)

Digital wallets have gained significant popularity as more consumers and businesses embrace online transactions. These solutions allow users to store their payment information securely and make purchases with a few clicks. Some of the leading digital wallets include PayPal, Google Pay, Apple Pay, and Samsung Pay.

PayPal, for instance, provides a platform where users can link their bank accounts, credit cards, and debit cards to make seamless online payments. Google Pay and Apple Pay enable users to store their card information on their smartphones and make contactless payments using their devices at supported terminals.

The key advantages of digital wallets include enhanced security through encryption and tokenization, convenience for users who do not need to enter their payment details repeatedly, and the ability to integrate loyalty programs and special offers. Businesses benefit from faster checkout processes, lower transaction failures, and an improved customer experience.

While digital wallets offer numerous advantages, merchants should ensure they support the most popular wallets to cater to a diverse customer base. Additionally, keeping up with technological advancements and security protocols is essential to protect customer data.

Bank Transfers

Bank transfers, also known as electronic funds transfers (EFTs), remain a reliable method for processing payments. This method involves transferring money directly from one bank account to another, either within the same bank or between different banks. Bank transfers are widely used for both personal transactions and business payments.

This payment method is particularly useful for large transactions, international payments, and situations where credit card payments are impractical. Bank transfers offer a high level of security, as they are conducted through the banking system, and are typically less costly compared to credit card transactions.

Businesses may opt for bank transfers to pay suppliers, handle payroll, or receive payments for large orders. It is essential to use reliable banking services and ensure proper documentation to track transactions and maintain accurate records.

However, bank transfers may take longer to process compared to card payments or digital wallets, making them less suitable for urgent transactions. Merchants should also be aware of the fees associated with bank transfers and choose their banking partners wisely to minimize costs.

Cryptocurrency Transactions

Cryptocurrency transactions are an emerging trend in the payment processing landscape. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin provide an alternative to traditional payment methods, offering decentralized and secure transactions.

These digital currencies are based on blockchain technology, ensuring transparency and security. Transactions conducted using cryptocurrencies can be executed quickly, regardless of geographical boundaries, making them attractive for international payments.

For businesses, accepting cryptocurrency payments can open up new markets and cater to tech-savvy customers. Cryptocurrencies offer lower transaction fees compared to traditional payment methods, and they reduce the risk of chargebacks. However, fluctuations in cryptocurrency values may pose challenges, and businesses need to have mechanisms in place to manage these risks.

To integrate cryptocurrency transactions, merchants need to adopt payment gateways that support digital currencies and ensure compliance with relevant regulations. Security measures should be in place to protect against potential cyber threats, and it is advisable to stay informed about market trends and developments in the cryptocurrency space.

Buy Now Pay Later (BNPL) Options

Buy Now Pay Later (BNPL) options have become increasingly popular, particularly in the e-commerce sector. These services allow consumers to purchase products and defer payment over a specified period, either in installments or at a later date. Popular BNPL providers include companies like Klarna, Afterpay, and Affirm.

BNPL solutions offer flexibility to consumers, enabling them to make purchases without immediate financial burden. This can encourage higher spending, as customers can spread the cost of their purchases, leading to increased sales for merchants.

For businesses, offering BNPL options can attract more customers, reduce cart abandonment rates, and increase average order values. This payment method is particularly effective for high-ticket items, where consumers might be hesitant to pay the full amount upfront.

To integrate BNPL options, merchants need to collaborate with BNPL providers and ensure that their checkout processes are seamless and user-friendly. It is also essential to communicate the terms and conditions of BNPL options clearly to avoid any misunderstanding or disputes.

While BNPL services offer numerous benefits, merchants should be mindful of the impact on cash flow and ensure that they partner with reputable BNPL providers. Managing customer expectations and maintaining transparency are crucial for retaining trust and ensuring a positive shopping experience.

Understanding and utilizing these popular payment processing methods can help businesses optimize their transactions, cater to diverse customer preferences, and remain competitive in a dynamic marketplace. Choosing the right payment solutions involves assessing business needs, evaluating costs, and staying updated on industry trends and regulations. With the support of a reliable partner like Q Solutions LLC, businesses can navigate the complexities of payment processing and achieve their financial objectives effectively.

Navigating the World of Payment Processing

As businesses continue to adapt to a digital-first world, understanding payment processing becomes increasingly crucial. Payment processing involves a series of steps that ensure transactions are safe, authenticated, and finalized efficiently. By breaking down these steps, Q Solutions LLC aims to provide businesses with a clear overview on how payment processing works, enhancing their ability to manage transactions and ensure customer satisfaction.

Overview of payment processing

Authorization Process

The authorization process is one of the first steps in payment processing where a transaction is first initiated. When a customer uses their credit or debit card to make a purchase, the payment information is sent from the merchant’s terminal to the payment processor. The payment processor, then, sends this information to the customer’s issuing bank.

The issuing bank verifies whether there are sufficient funds available for the transaction and checks for any signs of fraudulent activity. Once the transaction passes these checks, the bank provides an authorization code, which notifies the merchant that the funds are available and the transaction can proceed. This step is crucial as it protects both the merchant and the customer from potential risks like declines or fraud.

Authentication Steps

Authentication steps are essential to ensure that the payment method used by the customer is legitimate. This involves several layers of security checks, including the use of CVV codes, AVS (Address Verification Service), and sometimes multi-factor authentication.

The CVV code, a three or four-digit number on the card, helps verify that the card is physically present with the customer. AVS, on the other hand, matches the billing address provided by the customer with the address on file with the issuing bank. These steps add an extra layer of security by confirming that the person making the transaction possesses the necessary card information.

In some cases, especially for larger transactions or those flagged as high-risk, additional authentication steps such as SMS or email verification, are employed. These measures ensure that the transaction is conducted by the authorized cardholder and not by someone who might have acquired the card details illegitimately.

Settlement Process

Once the transaction has been authorized and authenticated, it moves forward to the settlement process. This is where the funds are actually transferred from the customer’s bank account to the merchant’s account. The payment processor consolidates all the authorized transactions and sends them to the relevant card networks (such as Visa, Mastercard, etc.) for settlement.

Card networks then communicate with the issuing banks to transfer the funds. This process usually takes 24-48 hours, and during this time, the funds are in a kind of hold or pending state. Once settled, the funds are made available in the merchant’s bank account, less any transaction fees that may apply. It is during this step that merchants receive the revenue from the sales, and customers see the finalized charges on their bank statements.

The settlement process is vital as it marks the completion of the transaction cycle, ensuring that all parties involved – the customer, the merchant, and the banks – are accurately and fairly compensated.

Understanding these fundamental steps of payment processing can greatly assist businesses in managing their payment systems more effectively. By utilizing the secure and reliable services provided by Q Solutions LLC, businesses can navigate the complexities of payment processing with confidence and ensure smoother operations.

Key Trends and Technologies in Payment Processing

Payment processing is at the heart of commerce, enabling transactions securely and seamlessly. As technology advances, new trends and innovations are shaping the payment landscape. Businesses that stay abreast of these developments can better navigate the complexities of financial technology, ensuring efficient and secure transactions for their customers. In this blog, we’ll explore key trends and technologies in payment processing, including emerging practices such as mobile payments and e-wallets, the use of AI in fraud detection, the future of cryptocurrency in payments, and the significance of robust security measures and best practices.

Emerging Trends: Mobile Payments and E-Wallets

The advent of mobile payments and e-wallets has transformed how transactions are conducted. More consumers are opting for digital wallets like Apple Pay, Google Wallet, and Samsung Pay, allowing them to complete transactions with just a few taps on their smartphones. This trend is driven by the convenience, security, and speed offered by mobile payments.

For businesses, integrating mobile payment options can attract tech-savvy customers who prefer to use their phones over traditional cards. Additionally, mobile payments can provide valuable insights into consumer behavior, allowing businesses to tailor their services and promotions.

E-wallets also offer the benefit of enhanced security. These digital wallets store payment information securely, reducing the risk of data breaches. Furthermore, they often include biometric authentication methods such as fingerprint and facial recognition, adding an extra layer of security.

Mobile payments illustration

AI in Fraud Detection

Artificial Intelligence (AI) is revolutionizing the way fraud is detected in payment processing. Traditional methods of fraud detection often involved manual checks and outdated algorithms, which were less effective against sophisticated cyber threats. Today’s AI-driven solutions offer real-time monitoring and adapt to new fraud patterns quickly.

Machine learning models analyze vast amounts of transaction data, identifying anomalies and flagging potentially fraudulent activities. These systems can learn from historical fraud cases, improving their accuracy over time. As a result, businesses can mitigate risks and protect their customers’ financial information.

AI enables predictive analytics, helping businesses to anticipate fraud before it occurs. This proactive approach not only saves money on fraud-related expenses but also fosters trust among customers. By investing in AI for fraud detection, companies can enhance their reputation for security.

Future of Cryptocurrency in Payments

Cryptocurrency has garnered significant attention in the financial world. Bitcoin, Ethereum, and other digital currencies offer decentralized and secure transaction methods. While adoption has been gradual, the future of cryptocurrency looks promising, especially with increased regulation and development of payment solutions.

Businesses are beginning to accept cryptocurrencies as payment, giving customers more flexibility and the option to use their digital assets. Blockchain technology, the foundation of cryptocurrencies, ensures transparent and tamper-proof transactions, which can significantly reduce fraud and improve transaction integrity.

The volatility of cryptocurrencies remains a challenge. However, stablecoins, which are designed to have a stable value, could mitigate this issue, making it easier for businesses to accept cryptocurrency payments without worrying about value fluctuations.

Significance of Security Measures and Best Practices

Security in payment processing is paramount. With the rise of cyber threats, businesses must implement robust security measures to protect their transactions and customer data. Here are some best practices for ensuring payment security:

- Encryption: Encrypting transaction data during transmission ensures that sensitive information cannot be intercepted by unauthorized parties.

- Tokenization: Tokenization replaces sensitive data with unique tokens, which can be used for transactions without exposing the original data.

- PCI Compliance: Adhering to Payment Card Industry Data Security Standard (PCI DSS) helps businesses meet required security standards.

- Regular Security Audits: Conducting frequent security audits helps identify vulnerabilities and ensure compliance with security standards.

- Multi-factor Authentication (MFA): Implementing MFA adds an additional layer of security by requiring multiple forms of verification before granting access.

By prioritizing security, businesses can safeguard their payment systems against breaches and cyberattacks. Ensuring secure transactions builds customer trust and supports the long-term success of any business.

In conclusion, staying informed about the latest trends and technologies in payment processing is crucial for businesses seeking to provide efficient and secure transaction experiences. As mobile payments, AI in fraud detection, cryptocurrency, and robust security measures evolve, companies that embrace these advancements will be well-positioned to navigate the complexities of modern payment systems. Q Solutions LLC is dedicated to offering reliable and tailored payment processing solutions to help businesses reduce costs, ensure security, and enhance customer satisfaction.

Navigating the World of Payment Processing in 2025

In the dynamic landscape of 2025, payment processing has evolved tremendously, addressing both the opportunities and challenges that businesses face today. As financial technology ascends to new heights, businesses must adapt to these changes, ensuring streamlined, secure, and efficient transaction systems. This blog delves into the common issues surrounding payment processing and elucidates strategies to mitigate these concerns.

Common Issues: Chargebacks and Security Risks

Chargebacks and security risks are among the most pressing issues in payment processing. Chargebacks occur when customers dispute a transaction, leading to potential revenue loss for businesses. These disputes can arise due to fraudulent activities, dissatisfaction with a product or service, or errors during the transaction process. Chargebacks not only directly impact the bottom line but also incur administrative costs and can damage a business’s reputation.

Security risks are equally daunting. With the rise of online transactions and digital payments, cyber threats become more sophisticated. Payment gateways must defend against hacking attempts, data breaches, and identity theft. Ensuring robust security measures is crucial for maintaining customer trust and safeguarding financial data.

Payment Processing Challenges and Solutions

Strategies to Mitigate Chargebacks

To reduce the frequency and impact of chargebacks, businesses can implement several strategies:

- Clear Communication: Ensure that all product descriptions, terms of service, and refund policies are clearly stated on your website. Transparent communication reduces the likelihood of misunderstandings that may lead to chargebacks.

- Use Reliable Payment Gateways: Employ reputable payment gateways that offer robust fraud detection mechanisms. These systems can identify suspicious patterns and prevent fraudulent transactions before they occur.

- Offer Excellent Customer Service: Rapid response to inquiries and resolving disputes amicably can reduce chargebacks. Establishing a dedicated customer service team can alleviates issues before they escalate to formal disputes.

- Monitor Transactions: Regularly review transaction data for anomalies. Implementing transaction monitoring tools can help detect and address potential fraud early.

Additionally, educating customers about the transaction process and their responsibilities can foster a cooperative relationship, further minimizing disputes and chargebacks.

Securing Payment Systems

Security is paramount in payment processing, and several methods can enhance the resilience of payment systems:

- Encryption: Utilize advanced encryption techniques to protect sensitive data during transmission. End-to-end encryption ensures that data remains confidential and secure from unauthorized access.

- Tokenization: Tokenization replaces sensitive card details with unique tokens during transactions. These tokens are useless to hackers, reducing the risk of data breaches.

- Multi-Factor Authentication (MFA): Implement MFA protocols to authenticate users. MFA adds an extra layer of security by requiring multiple forms of verification before granting access.

- Regular Security Audits: Conduct frequent security audits to identify and address vulnerabilities in the payment infrastructure. Staying proactive ensures that your systems are robust and up-to-date.

Furthermore, partnering with cybersecurity experts can provide insights and solutions tailored to your specific payment processing needs. Professional support can reinforce your security measures, keeping your transactions safe.

Adaptations for Future Trends

As payment trends evolve, businesses must stay ahead by adapting to these changes:

- Mobile Payments: The surge in mobile payments necessitates systems that accommodate mobile transactions. Optimize your payment gateways for mobile compatibility, ensuring a user-friendly experience for customers on smartphones and tablets.

- Cryptocurrency Integration: Cryptocurrencies continue to gain traction, and incorporating them into your payment options can attract a broader customer base. Ensure that your systems can handle cryptocurrency transactions efficiently and securely.

- Voice Commerce: Voice-activated transactions are becoming popular. Adopt technologies that support voice commands for an intuitive shopping experience.

- Biometric Authentication: Leveraging biometric data such as fingerprints and facial recognition for authentication enhances security and expedites transactions.

Adapting to these trends positions businesses as forward-thinking and responsive to customer preferences, fostering growth and trust.

Compliance with Payment Regulations

Another crucial aspect is compliance with evolving payment regulations. Regulatory bodies continually update rules to address new challenges in the financial ecosystem. Non-compliance can result in penalties and legal issues, affecting business operations.

- Stay Informed: Regularly update your knowledge on regulatory changes pertaining to payment processing. Understanding the legal landscape ensures that your processes remain compliant.

- Consult Legal Experts: Engage with legal professionals who specialize in financial regulations. Their expertise can guide you in implementing compliant payment systems.

- Document Processes: Maintain detailed documentation of all transactions and compliance measures. This transparency protects your business in case of audits or disputes.

Adhering to regulations not only avoids penalties but also enhances your credibility and trustworthiness in the market.

Conclusion

The realm of payment processing in 2025 presents various challenges but also opportunities for innovation and growth. By tackling common issues such as chargebacks and security risks, and embracing future trends and regulatory requirements, businesses can build resilient and customer-friendly payment systems. Q Solutions LLC is here to support you with expert guidance and tailored solutions, ensuring that your payment processing is efficient, secure, and compliant.

Ready to reduce payment processing costs and find reliable solutions? Partner with Q Solutions LLC today, and transform your payment processing experience.

Choosing the Right Payment Processor

In the complex landscape of payment processing, businesses often face the challenge of selecting the right payment processor. With a myriad of options available, making the right choice can significantly impact transaction costs, customer satisfaction, and overall operational efficiency. This guide aims to provide an insight into evaluating payment processors, ensuring businesses can make informed decisions that align with their specific needs.

Evaluating Payment Processors Based on Fees

One of the critical factors to consider when choosing a payment processor is the fee structure. Different processors may offer varying fee models, such as flat-rate fees, interchange-plus fees, or tiered fees. It’s essential to understand the total cost every processor charges, including potential hidden fees like setup fees, chargeback fees, or early termination fees. A comprehensive evaluation of these costs can help businesses avoid unexpected expenses and manage their budgets more efficiently.

When evaluating fees, it is also worthwhile to consider the processor’s pricing transparency. Some processors provide clear and straightforward pricing, while others may have more complex and less transparent fee structures. Opting for a processor like Q Solutions LLC, known for their commitment to transparency, can make a significant difference in maintaining trust and avoiding costly surprises.

Integration Capabilities

Another crucial aspect of selecting a payment processor is its integration capabilities. The ability to seamlessly integrate with existing systems, such as eCommerce platforms and accounting software, can save substantial time and reduce operational friction. Payment processors that offer APIs, plugins, and developer support tend to facilitate smoother integrations, enhancing the overall user experience for both merchants and customers.

For businesses looking to expand, scalability is another vital consideration. A payment processor that can grow with your business, offering integrations with additional platforms or new payment methods, can provide long-term benefits. This flexibility is essential for adapting to evolving market demands and customer preferences.

Payment Processing

Customer Support

Customer support is a frequently overlooked but vitally important factor when choosing a payment processor. Issues with payment processing can occur at any time, and access to reliable and responsive customer service is essential for resolving problems promptly. Evaluating customer support includes checking the availability of support channels (such as phone, email, or live chat), the responsiveness of the support team, and the quality of the assistance provided.

Additionally, processors that offer comprehensive resources, including FAQs, knowledge bases, and troubleshooting guides, empower businesses to resolve common issues independently. This proactive support approach can minimize downtime and ensure that businesses continue to operate smoothly even when technical issues arise.

Features

The range of features offered by a payment processor is another critical consideration. Features such as fraud detection and prevention, recurring billing, and support for multiple currencies are indispensable for many businesses. Advanced reporting and analytics can provide valuable insights into transaction patterns and customer behavior, helping businesses make data-driven decisions.

As payment methods continue to evolve, support for options like mobile payments, digital wallets, and contactless payments becomes increasingly important. A payment processor that keeps pace with technological advancements can offer a competitive edge in terms of customer convenience and security. For example, Q Solutions LLC provides robust fraud prevention measures and customizable gift and loyalty card programs, enhancing both security and customer engagement.

In conclusion, choosing the right payment processor involves a thorough evaluation based on fees, integration capabilities, customer support, and features. By carefully considering these factors, businesses can select a payment processor that not only meets their current needs but also supports future growth and adapts to the ever-changing landscape of payment processing.

Future Trends in Payment Processing

Image depicting future payment trends

The landscape of payment processing is continuously evolving, shaped by advances in technology and shifts in consumer behavior. As we look towards 2025, several key trends are expected to emerge, impacting both businesses and consumers. This blog will delve into these anticipated changes, exploring how payment technology is set to advance and how consumer preferences are likely to shift.

Anticipated Changes in Payment Technology

Technological advances are at the forefront of changes in payment processing. By 2025, we can expect to see further integration of artificial intelligence (AI) and machine learning into payment systems. These technologies will enable more sophisticated fraud detection and prevention, ensuring transactions are secure and reducing the risk of financial loss for businesses and consumers alike.

Another significant development will be the growth of biometric authentication methods. Fingerprint scanning, facial recognition, and even voice recognition are becoming more common in payment processes, providing a more secure and user-friendly alternative to traditional passwords and PINs. This shift towards biometric verification will enhance payment security and convenience, making transactions faster and more reliable.

The rise of blockchain technology will also play a pivotal role in the future of payment processing. Blockchain’s decentralized nature ensures greater transparency and security in transactions, reducing the likelihood of fraud and errors. Its application in cross-border payments is particularly notable, as it can significantly speed up international transactions and reduce costs by eliminating the need for intermediaries.

Furthermore, we will likely see a continued expansion of contactless payment options. Near Field Communication (NFC) technology is now widely used in contactless cards and mobile wallets, allowing for swift and convenient transactions. As consumers become more accustomed to these methods, businesses will need to adapt and ensure they can accept a range of contactless payment options.

Shifts in Consumer Preferences

Consumer preferences in payment methods are constantly evolving, influenced by technological advancements and changing lifestyles. One of the most notable trends is the increasing preference for mobile payments. With the proliferation of smartphones and mobile devices, consumers are more inclined to use mobile wallets and payment apps, such as Apple Pay, Google Wallet, and Samsung Pay. This trend is expected to continue growing, driven by the convenience and speed mobile payments offer.

The popularity of subscription-based services is another trend that will shape consumer preferences. From streaming services to meal kits, consumers are increasingly opting for recurring payments. Businesses will need to accommodate this shift by offering flexible payment options that support subscriptions, ensuring they meet the demands of their customers.

As consumer awareness of data privacy and security increases, there will be a demand for more transparent and secure payment processes. Consumers are becoming more discerning about how their data is handled, and businesses that prioritize payment security and transparency will gain a competitive edge. Implementing robust payment security measures and clearly communicating these efforts to consumers will be critical for building trust and loyalty.

Lastly, we can anticipate a rise in demand for personalized payment experiences. Consumers are seeking more tailored and convenient options, such as loyalty programs, personalized discounts, and payment plans. By leveraging customer data and analytics, businesses can offer customized payment solutions that cater to individual preferences, enhancing the overall customer experience.

Conclusion

As we delve into the concluding section of our exploration of payment processing in 2025, it’s crucial to revisit the essential points covered throughout this blog. Reflecting on our journey through the evolving landscape of online payments, payment security, financial technology, payment regulations, and the myriad of payment gateways and ecommerce solutions, we can better prepare for the future of payment systems.

Recap of Key Points Covered

The realm of payment processing is dynamic and ever-changing. Through this blog, we have examined various aspects of this field, including the importance of staying updated with payment trends and the necessity of adhering to evolving payment regulations.

Understanding and leveraging payment gateways is vital for businesses aiming to thrive in the e-commerce space. These systems facilitate online transactions, providing seamless interfaces between merchant services and digital payments. The discussion on mobile payments illustrated how the rise of smartphones and mobile technology has transformed consumer behavior and business strategies.

Our emphasis on payment security underscores the need for robust measures to protect sensitive financial information from fraudulent activities. This aspect of payment processing cannot be overlooked, as security breaches can result in significant financial and reputational damage.

We explored edge financial technology solutions that drive continuous innovation in payment systems, bringing agility and adaptability to businesses. Additionally, we assessed the impact of payment regulations on both businesses and consumers, emphasizing compliance as a non-negotiable element in maintaining a trustworthy payment environment.

Finally, we considered the future landscape of payment systems and the trends likely to shape it. Predictive technologies, AI-driven payment solutions, and the integration of blockchain technology were highlighted as potential game-changers that businesses must keep an eye on.

Final Thoughts on Preparing for the Future of Payment Processing

As we move towards an increasingly digitalized world, the importance of adapting to tomorrow’s payment trends cannot be underestimated. Businesses must remain agile and welcome changes and innovations in financial technology to stay ahead in a competitive market.

Investing in reliable payment security measures will continue to be paramount. Implementing advanced encryption technologies and multi-layered authentication processes ensures that transactions are conducted in safe and secure environments, fostering trust among consumers.

Awareness and compliance with payment regulationswill be critical. As regulations evolve to address emerging challenges in the digital realm, businesses need to ensure that their operations remain within legal frameworks, avoiding costly penalties and ensuring smooth functioning.

Furthermore, embracing the latest developments in e-commerce solutions and payment gateways is essential for businesses aiming to enhance their reach and customer experience. These technologies not only simplify transactions but also enable detailed analytics and personalized customer engagement.

Indeed, success in the future of payment processing requires a proactive approach. Businesses need to consistently educate themselves about new technologies, stay compliant with regulations, and prioritize security to build loyalty and trust among their customers.

Preparing for the evolving landscape entails not just understanding the current trends but also anticipating future shifts. Cybersecurity advancements, AI, machine learning, and blockchain are likely to redefine how transactions are conducted and processed.

In conclusion, Q Solutions LLC stands ready to guide businesses through this intricate landscape of payment processing. With expertise, professionalism, and a commitment to transparency, we are here to provide the customized solutions needed to optimize transactions and save clients money. Let us navigate the future of payment processing together, ensuring dependable and secure payment solutions for businesses of all sizes.

No responses yet