Merchant Dual Pricing Program

Save up to 90% on credit card processing fees. We’ll optimize your payments and save you money.

Why Choose Dual Pricing?

Transparency

Dual Pricing allows businesses to consistently display cash and card transaction amounts from shelf or menu through the checkout process. This transparent approach maximizes profits and enhances customer satisfaction by clearly displaying the pricing on the POS terminal at the time of the sale. The Dual Pricing program empowers the customer to choose their preferred method of payment.

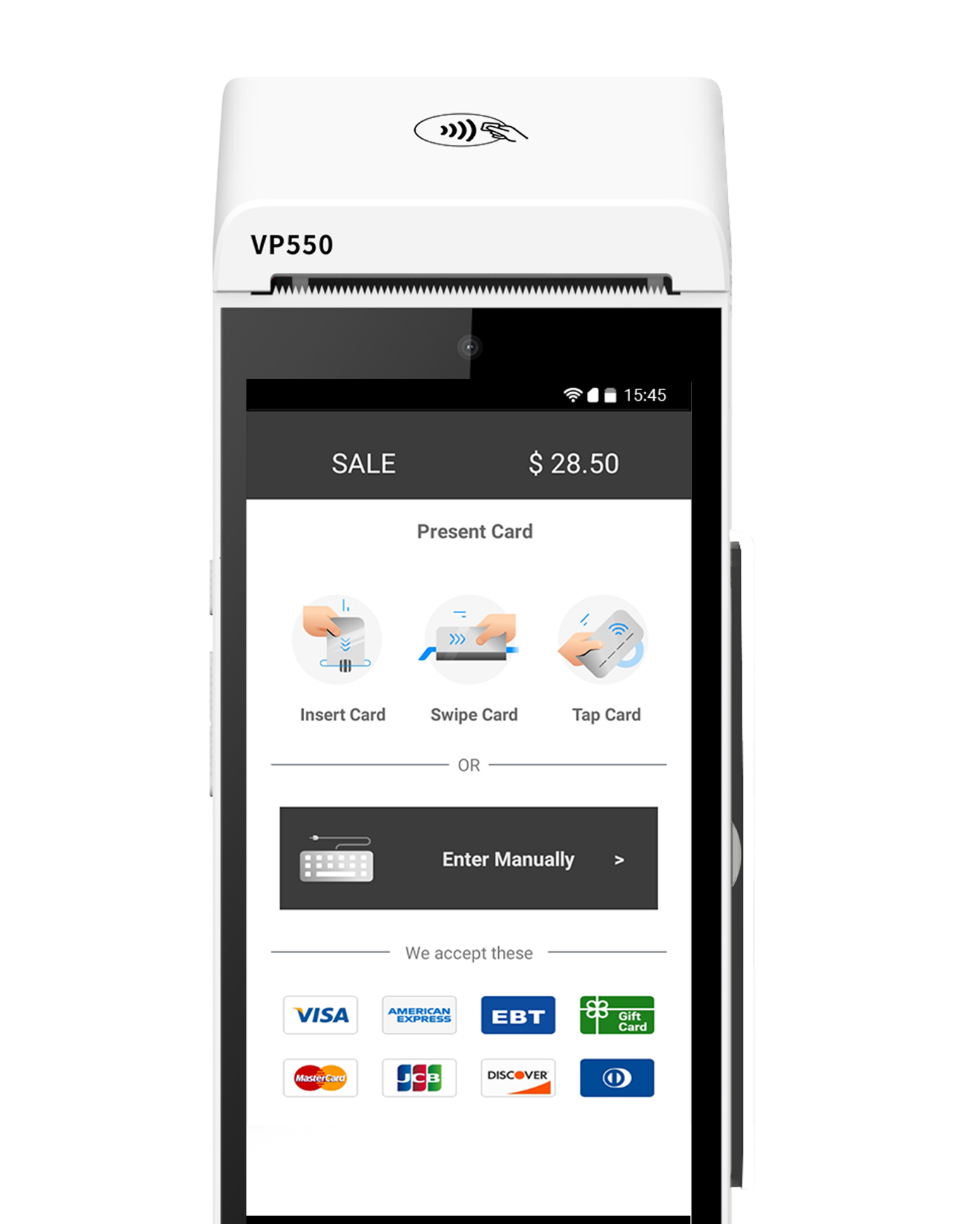

Card and Cash Price Displayed

Dual Pricing offers the same benefits as surcharge and fee-based cash discount programs, with a customer-friendly approach.

Customer selects method of payment

Dual Pricing is a transparent pricing model giving customers the option at checkout: Pay the list pricing using Credit or receive a discount by paying with cash.

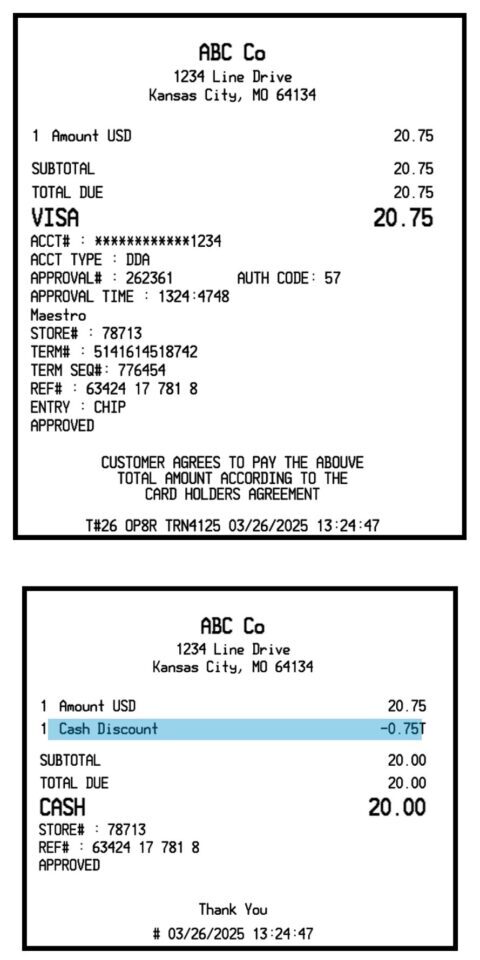

The receipt shows discounts applied

The receipt shows a discount being applied to cash transactions, while the card payment receipt shows the customer paying full price.

Enhance Your Profit Margins

Dual pricing is a powerful tool for merchants looking to manage credit card processing fees while offering customers more payment flexibility.

To encourage cash payments, dual pricing can be highly effective. That said, it is important to appropriately promote this payment model to ensure customers are aware of it and bring cash to your store.

While the average payment processing fee is less than 3%, this figure can quickly eat into your margins if many of your customers pay with credit cards. Implementing dual pricing encourages customers to use cash, ensuring credit card fees don’t destroy profits. Also, if your customers choose to use credit cards, they pay the fees for you in the total price.

Passing payment processing costs onto customers without them knowing the benefits of using cash hurts customer loyalty. By offering dual pricing, your business allows your customers to make an informed choice before paying.

Get Started using Dual Pricing today!

8 Common Misconceptions About Dual Pricing

Myth #1: It’s Illegal

Dual pricing is legal and complies with card network regulations, as long as merchants disclose it properly to customers. This requires proper signage and transparent communication. Dual pricing is a viable option for merchants to manage credit card fees while offering payment choice.

Myth #2: It’s the Same as Surcharging

Dual price processing offers two distinct prices at checkout, promoting greater pricing transparency and giving customers the freedom to choose their preferred payment method without penalty.

Myth #3: Customers Will Be Upset

Merchants fear that customers may react negatively to two prices at checkout. Yet, when communicated transparently, most customers appreciate saving by paying with cash. Overcoming the mindset of losing some customers to save on processing fees is crucial for alternate pricing programs. Dual pricing faces the least resistance from customers due to its transparency.

Myth #4: It’s Too Complicated to Implement

Implementing a dual pricing model can seem daunting, but Q Solutions provides simple, integrated solutions that make it easy for merchants to adopt this pricing strategy. Providers of the service offer equipment and gateways that come pre-enabled to support two prices at checkout, with easy reconciliation and reporting.

Myth #5: You Have to Show Two Prices on All Products and Services

Merchants may update their pricing to show two distinct prices, but it is not necessary to run a legal dual pricing program. If only one price is displayed on merchandise, it must reflect the card price. The dual pricing model must also be explained through signage at the store entrance, at checkout, and throughout the store. Technology must be enabled on terminals so that both the credit and cash price options are displayed at checkout. Staff should be trained to explain the dual pricing model at checkout.

Myth #6: It’s Difficult to Communicate to Customers

Proper signage and staff training can effectively communicate the dual pricing model. Clear explanations and visible pricing help ensure customers are informed and understand their options.

Q Solutions will provide some signage to be used in your business. We will also provide employee training.