Understanding Your Payment Processing Costs

Did you know that small businesses can lose up to 3% of their annual revenue due to credit card processing fees? This alarming statistic underscores the importance of understanding these costs in your financial strategy. For small business owners, credit card processing fees are more than just a line item on the expense report; they directly impact profitability and cash flow.

Defining Credit Card Processing Fees

Credit card processing fees are the costs of accepting and processing credit card transactions. These fees typically include various elements such as interchange fees, assessment fees, and the processor’s markup. They can significantly affect a business’s net revenue, making it essential to grasp what these fees entail and how they vary based on transaction types and payment methods. Understanding these fees is crucial for small business owners to maintain a healthy bottom line and ensure cost transparency in financial planning.

Blog Post Structure and Value Proposition

This blog post will guide you through the intricacies of payment processing fees, providing a comprehensive breakdown of the costs involved in financial transactions. We will dive deep into the different types of fees, helping you analyze your current payment processing expenses or evaluate potential solutions. Through thorough cost analysis, we aim to equip you with the knowledge to make informed decisions regarding your payment solutions, ultimately leading to a more profitable business model.

Decoding the Components of Credit Card Processing Fees

Understanding credit card processing fees is essential for any business owner looking to manage their transaction costs effectively. To navigate this intricate landscape, it’s crucial to decode the various elements contributing to payment fees. This guide will delve into the fees associated with credit card processing and explain the key players’ roles.

Interchange Fees, Assessment Fees, and Markup Fees

Interchange fees are the costs paid to the issuing bank by the acquiring bank each time a card is used to make a purchase. These fees are typically a percentage of the transaction amount plus a flat fee. On the other hand, assessment fees are charged by card networks like Visa and MasterCard as a percentage of the transaction volume. Finally, markup fees are added by payment processors as their profit margin, encompassing the costs of managing and facilitating transactions. Together, these components form the basis of merchants’ fee structure.

Additional Fees Incurred by Merchants

Alongside the primary fees, there are additional charges that businesses should be aware of. Chargebacks, when a customer disputes a transaction, can incur significant costs for merchants. PCI (Payment Card Industry) compliance fees are also essential, as non-compliance can lead to hefty penalties. Additionally, some merchants might encounter statement fees, which are charged for providing account statements and summaries of transactions.

Key Players in the Payment Processing Ecosystem

The payment processing journey features several stakeholders, each with distinct roles. The issuing bank issues credit cards to consumers; the acquiring bank enables merchants to accept these transactions. The payment processor acts as an intermediary, handling the transaction flow, while card networks establish the rules and facilitate communication between the banks. Below is a simplified flowchart illustrating these relationships:

Importance of Transparency in Fee Structures

Cost transparency is vital for businesses evaluating their financial transactions. Understanding the breakdown of processing costs can empower merchants to negotiate better terms with their payment processors. It opens pathways for reviewing methods and implementing cost-saving measures that do not compromise consumer experiences.

By examining the various components of credit card processing fees, business owners can gain deeper insight into their transaction costs and adopt more informed strategies for managing and reducing expenses.

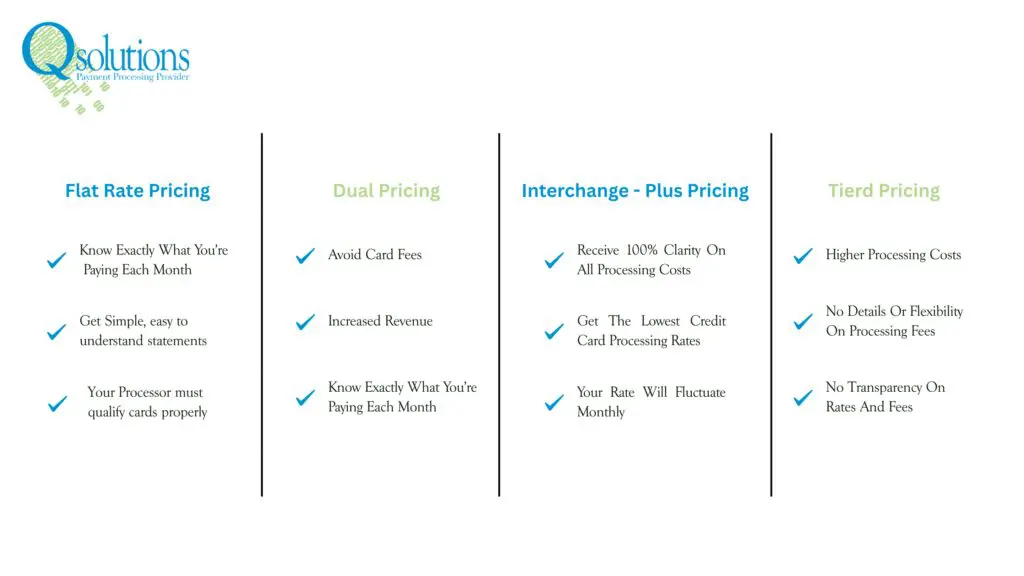

Navigating Credit Card Processing Pricing Models

Understanding the various credit card processing pricing models is crucial for business owners aiming to manage their transaction costs efficiently. The four primary models—flat-rate, interchange-plus, Dual Pricing, and tiered Pricing—offer distinct advantages and disadvantages depending on your business’s transaction volume and frequency. This section provides a comparative overview to help you choose the right model for your needs.

Flat-Rate Pricing

Flat-rate Pricing simplifies costs by charging a single percentage fee on every transaction, regardless of card type. For instance, a provider may charge a flat rate of 2.9% + $0.30 per transaction. If your business processes one hundred transactions totaling $10,000 in sales, you would pay $290 plus $30, totaling $320 in fees. The simplicity of this model works well for small businesses with fewer transactions but could be costly for high-volume merchants.

Dual Pricing

Dual Pricing, like Flat-rate pricing, a flat rate is charged for each transaction regardless of the card type. To mitigate the cost, the merchant would raise the price of their products and services and offer discounts to customers who pay via Cash or Check. For Example, if you have an item that costs $100.00, you would mark that item up 3%, charging $103.00. If a customer is paying by card, they will be charged $103.00, $100.00 will be deposited into the merchant bank account, while the $3.00 will be collected by the processor and used to pay the issuing bank, acquiring bank, and the card brands. If the customer chooses to pay via Cash or Check, they will receive a 3% discount, making their total $100.00. No fees will be collected by the processor for Cash or Check transactions.

Interchange-Plus Pricing

The interchange-plus model offers more transparency by displaying the actual cost of processing plus a predetermined markup. For Example, if the interchange fee is 1.8% + $0.10, and the provider adds a 0.2% markup, the total would be 2.0% + $0.10 per transaction. The same $10,000 in sales amounts to $200 in fees, which could be more economical for businesses with substantial sales volume.

Tiered Pricing

Tiered Pricing organizes transactions into different categories, each with its own fee structure. Transactions could be classified as qualified, mid-qualified, or non-qualified, with varying fees for each tier. If a business processes $10,000, the qualified rate might be 1.5%, the mid-tier 2%, and the non-qualified 3%. Total fees can vary significantly depending on the mix of transaction types, making this model less predictable.

Comparison

To help visualize the pros and cons of each model, consider the following:

Choosing the right payment processing pricing model involves analyzing your business’s needs, transaction types, and volume. Each model can lead to varying payment fees and overall cost implications, making it essential to assess which aligns best with your financial goals.

Strategies to Minimize Your Payment Processing Costs

Payment processing costs can significantly impact a business’s bottom line. By understanding the various factors that influence these fees, companies can adopt strategies to minimize them. Here, we explore effective methods to reduce your payment processing costs and enhance cost transparency.

Negotiate Rates with Payment Processors

Negotiating rates with your payment processor can lead to substantial savings. Many businesses are unaware that processing rates are often negotiable. Start by gathering quotes from multiple processors to compare their pricing models on merchant fees and transaction costs. Understanding these fee structures empowers you to approach your current provider with competitive offers, aiming to secure lower rates tailored to your business’s needs.

Utilize Level 2 and Level 3 Data

Using Level 2 and 3 data when processing transactions can significantly minimize credit card fees. This additional data categorizes detailed information about a transaction, allowing for lower interchange rates. By ensuring that your payment gateway supports this data type, you can decrease processing costs. Businesses that regularly process B2B transactions should particularly take advantage of these options to see a stark difference in their overall payment fees.

Consider Alternative Payment Methods

Exploring alternative payment methods, such as ACH transfers, offers a cost-effective way to handle payments. ACH transactions typically incur lower fees than traditional credit card payments, making them a viable option for businesses looking to cut down on transaction costs. By providing customers with multiple payment options, you can both enhance their experience and achieve savings on merchant fees.

In conclusion, understanding and addressing payment processing fees is essential for any business. By negotiating with processors, utilizing Level 2 and 3 data, and considering alternative payment solutions, you can effectively reduce your payment processing costs, ensuring that your financial transactions remain profitable.

Choosing the Right Payment Processor for Your Business

Selecting an appropriate payment processor is pivotal for the financial health of your business. With numerous options available, understanding the nuances behind processing fees and transaction costs can be overwhelming. This guide will help you navigate this landscape, ensuring you choose a solution that aligns with your unique business needs.

Comparison of Major Payment Processors

When evaluating potential payment processors, consider a detailed breakdown of their features and fees.

Selecting Based on Business Needs

Your choice of payment processor should reflect your specific business characteristics, such as your transaction volume and customer base. Processors like Q Solutions, LLC offer more robust tools that can save you money in the long term.

Key Considerations

It is essential to evaluate several key factors when selecting a payment processor. Pay special attention to contract terms, as hidden fees can quickly add up and burden your business with unforeseen costs. Customer support is another vital aspect; reliable support can mean a smooth experience and significant uptime. Finally, security features are non-negotiable; protecting customer data should be paramount in your decision-making.

Conclusion: Optimizing Your Payment Processing Strategy

Understanding and managing payment processing fees is crucial for any business aiming to improve its financial health. Companies can minimize costs and enhance their customers’ overall payment experience by adopting strategic approaches.

Key Strategies for Minimizing Credit Card Processing Fees

To effectively manage credit card processing fees, businesses should start with a thorough understanding of the various elements that contribute to processing costs. This includes familiarizing themselves with the fee structures of their payment processors, which often encompass interchange fees, assessment fees, and processor markup. Businesses can identify opportunities to reduce their merchant fees by assessing these components through detailed cost analysis. Additionally, actively monitoring billing cycles and comparing different payment solutions can lead to identifying more favorable rates. Implementing practices like Merchant Dual Pricing can also prove advantageous, allowing businesses to optimize their transactions based on the form of payment used.

Choosing the Right Payment Processor

Picking the right payment processor can significantly affect a business’s bottom line. Not all processors have the same fee structures or levels of transparency regarding costs. It’s essential for companies to perform due diligence: read reviews, compare offerings, and ask for an explanation of fees upfront. Negotiating terms and seeking rates that align with one’s transaction volume and business model is recommended. Building a relationship with a transparent processor can also lead to better support and potentially lower fees in the long run.

Contact Q Solutions LLC for Personalized Solutions

If you’re ready to enhance your payment processing strategy and seek tailored solutions that meet your unique needs, contact Q Solutions LLC. Our team is committed to providing dependable and customized payment processing solutions to help you optimize costs and improve your transaction processes. With our expertise, you can navigate the intricacies of merchant fees and enjoy better financial management.

No responses yet